Global Insurance Overview

The insurance industry is a major component of the economy by virtue of the amount of premiums it collects, the scale of its investment, and, more fundamentally, the essential social and economic role it plays by covering personal and business risks. In the year 2020, the world faced an unexpected challenge as a new virus spread fast around the globe, quickly becoming a pandemic. COVID-19 has threatened people’s health and had consequences on people’s lives and livelihoods, as governments tried to contain the spread of the virus through preventive measures such as business closures and lockdowns. This health crisis, and the unprecedented government responses, have completely modified the normal activities of people and businesses, impacting in turn the business performance and claim experience of insurers.

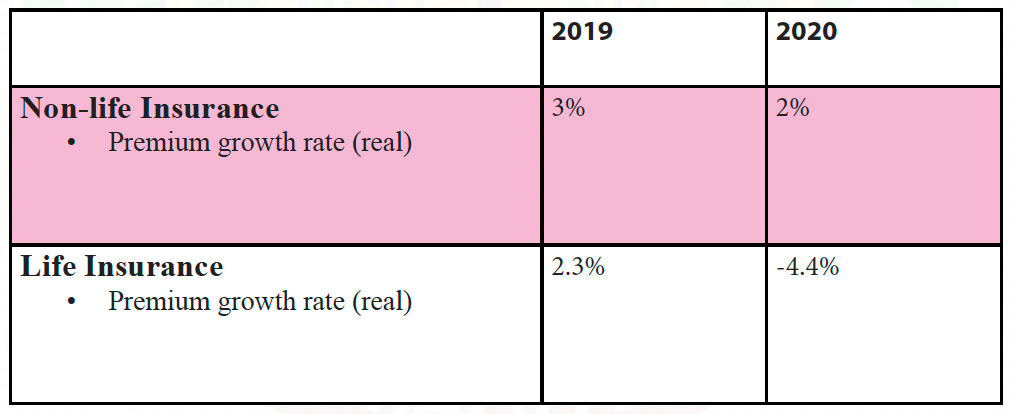

Table 1: Global insurance growth rate

According to the report of Swiss re sigma, the Global non-life and life PART ONE: INTRODUCTION premiums grew at trend by 3% and 2% respectively in real terms at 2019 and based on premium data collected from

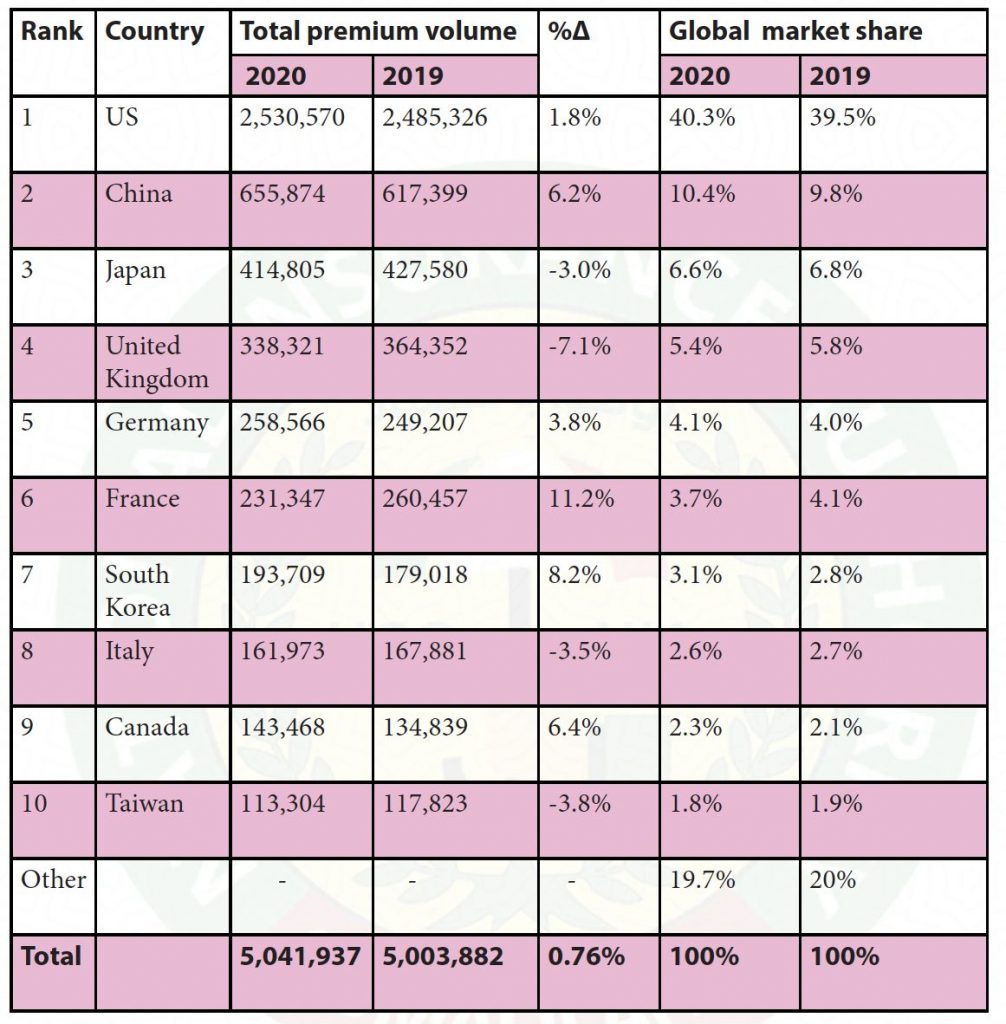

Table 2: Total insurance premiums in the largest Ten Global markets for 2019 and 2020(Amount in USD billion

147 countries, World insurance. As shown in table above, the global market in 2019 and 2020, the United States has consistently held the largest share of the insurance market globally.Alone, the USA made up over forty percent of the entire insurance market in 2020. The ten largest markets in 2020 combined held a market share of around 80 percent.

Overview of Insurance in Africa

Big players in the insurance sector have been increasingly focused on Africa over the past few years and brokers, insurers and reinsurers have all moved in to the region with mixed results: Africa only represents 1.5% of the global insurance market, despite being home to 13%of the world’s population.

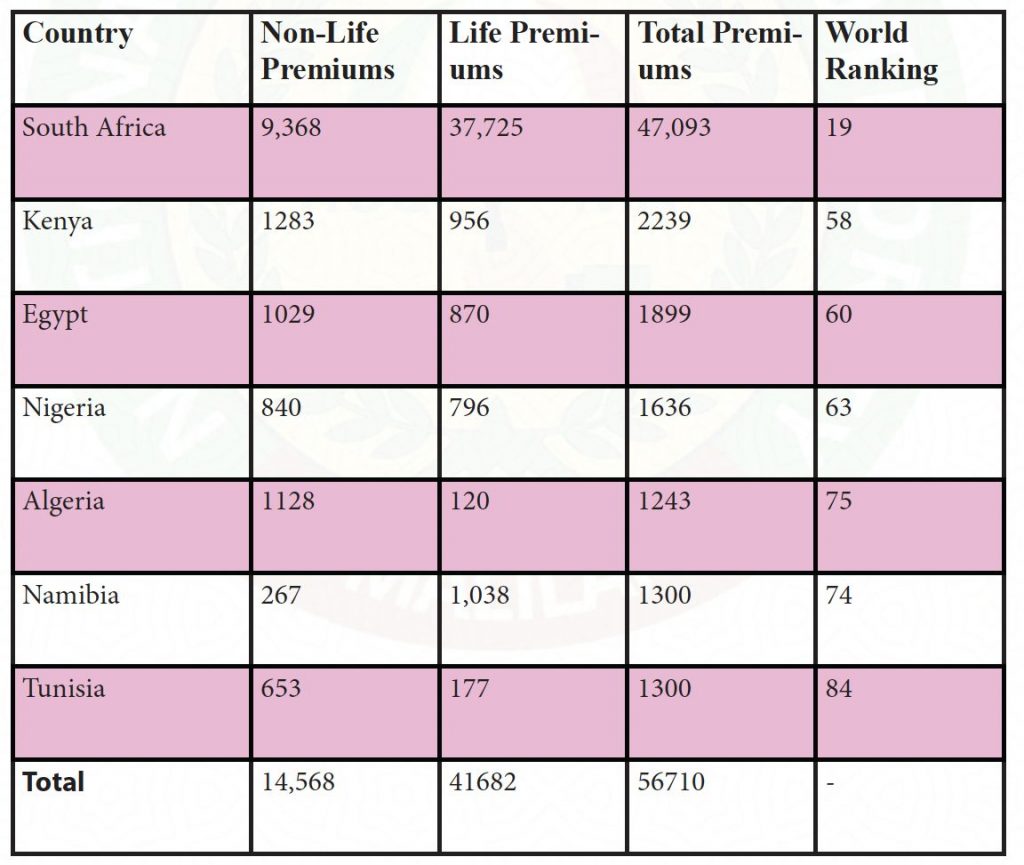

As shown in Table above, both the life and non-life insurance markets in Africa are dominated by South Africa. South Africa has more life premiums compared to non-life premiums. However, in Kenya, Egypt, Nigeria, and Tunisia, non-life insurance premiums tend to dominate the insurance market. Africa’s total insurance premium volume increased from US$ 65.2 billion in 2017 to US$ 68.15 billion in 2019.

Table 3: Total insurance premiums in the largest African markets in millions of $USD for 2019

However, African countries grew at different paces and these diverse growth patterns are merely indicative of the need to target certain markets and discover the opportunities blossoming in Africa’s new era of infrastructure development, rising incomes, and investment in new technologies and structural transformations. Due to the limited disposable income among the general population, insurance penetration rate is still very low for the African countries. In Somaliland the economic condition of country is same or even worse than the Africa countries which recorded lower penetration rate due to lower income of the population. However, last six years few Insurance companies was registered and started operation and there is big untapped market opportunity for companies interested in providing affordable insurance products suitable for the mass market.